48% of American credit card users are carrying debt that may take years to pay off, according to report!

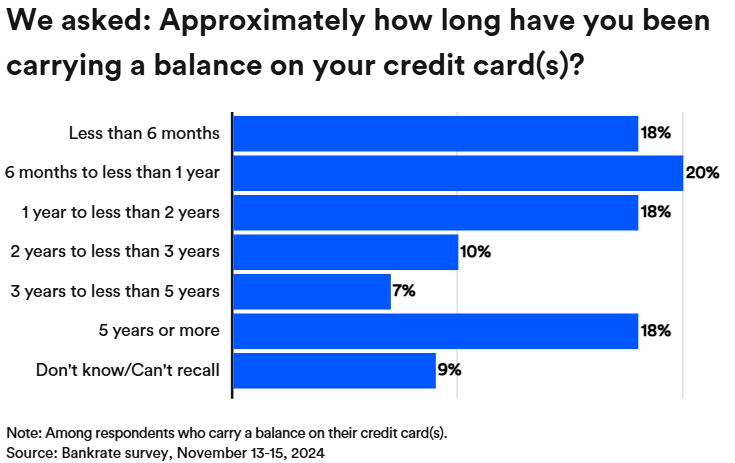

As 2025 begins, nearly half (48%) of U.S. credit card users are carrying debt from one month to the next, according to a recent Bankrate report. Among those with balances, 53% have been in debt for at least a year.

The survey found that 47% of borrowers mention unexpected/emergency expenses, such as medical bills or car and home repairs, as the main cause for debt. Meanwhile, 28% point to rising daily costs, 11% to retail purchases, and 9% to vacation/entertainment expenses as contributing factors.

“Credit card balances have risen 51% since early 2021 and credit card delinquencies are at their highest point since 2011, according to the Federal Reserve. High inflation and high interest rates have been a nasty combination, and while the worst is behind us, the cumulative effects are significant and will linger”, noted Ted Rossman, senior industry analyst at Bankrate

The average credit card balance per consumer has reached $6,380, according to TransUnion’s Q3 2024 credit industry insights report. If someone with the average balance of $6,380 only made minimum payments at an annual percentage rate (APR) of over 20%, it could take over 18 years to pay off the debt and they would pay more than $9,344 in interest, according to Rossman’s calculations.

Adding to the burden, the Bankrate survey found that 18% of the debtors have been carrying a balance for over 5 years. Another survey by WalletHub found that 24% of Americans expect to need more than six months to pay off their holiday-related debt, with many blaming inflation for overspending during the season.

“Many people need months to repay holiday bills after overspending”, said John Kiernan, editor at WalletHub.

Steps to Tackle Credit Card Debt in 2025

Getting started sooner rather than later can save you money in interest and help you regain financial control. Here are three practical steps to help you manage and reduce your credit card debt:

- Make Debt Repayment a Part of Your Budget: take time to adjust your budget, prioritizing debt repayment as a fixed expense. If your expenses are higher than your income, consider ways to cut costs or explore additional income opportunities, like asking for a raise or starting a side hustle. Planning ahead can ensure you stay on track and make consistent progress toward eliminating your debt.

- Use a Balance Transfer Card: a 0% balance transfer card can be a powerful tool for paying off your credit card debt without accruing extra interest. These cards offer an interest-free period, often up to 21 months, giving you time to focus solely on reducing the principal balance. “You could pay about $300 per month and knock out the average credit card balance in 21 months without owing any interest”, Rossman advised.

- Seek Help from a Credit Counselor: consider reaching out to a nonprofit credit counseling agency. These organizations often provide free or low-cost guidance tailored to your financial situation. “A solid backup plan, especially if you have a lower credit score or more than five or six thousand dollars in credit card debt, is to work with a reputable nonprofit credit counseling agency such as Money Management International”, Rossman noted.