About 27% of Americans are “doom spending” as a way to cope qith stress, according to a new report!

With the presidential election and a shaky economy, Americans are “doom spending” to ease their worries. According to a report from Intuit’s Credit Karma, 27% of shoppers admit to “doom spending” – spending money despite financial concerns or global uncertainty. Being especially common among younger adults, with 37% of Gen Z and 39% of millennials report engaging in this behavior.

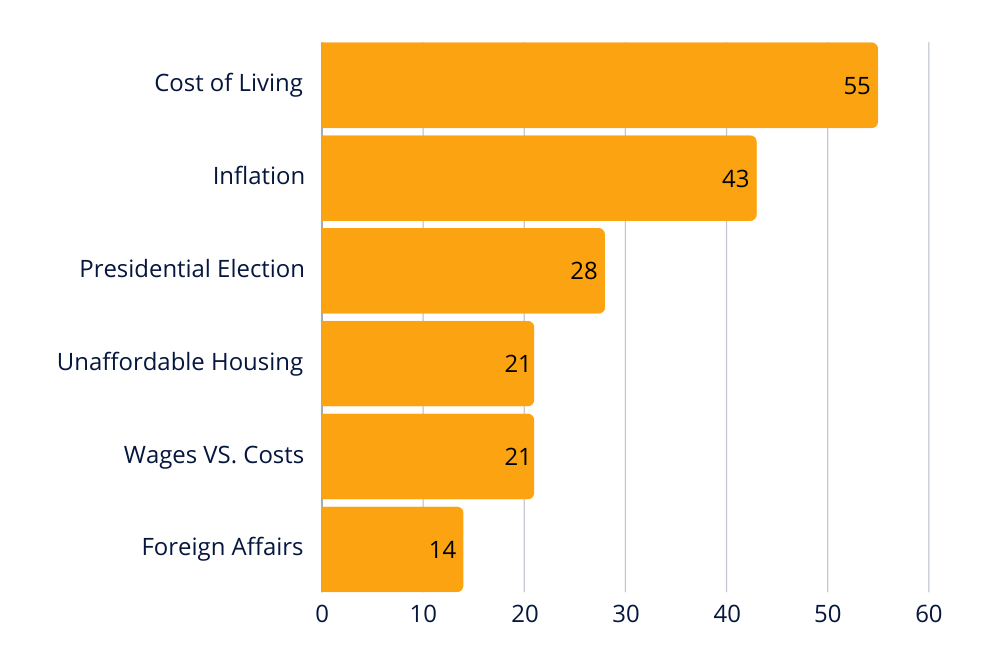

Credit Karma surveyed 1,001 adults in late October, with 71% of respondents feeling more anxious about the world and economy than they did last year and the key worries include: the cost of living (55%), inflation (43%), and the upcoming presidential election (28%). In addition to that, 36% of them find it hard to save money due to ongoing global uncertainty, with these concerns even higher among Gen Z (47%) and millennials (43%).

Key Worries That Lead To “Doom Spending”

Why People Feel The Need To “Doom Spend”

Credit Karma’s consumer financial advocate, Courtney Alev, explained that people may be shopping as a way to feel more in control during unpredictable times. Younger generations, who often spend more time on social media, are particularly affected. Credit Karma found that 70% of Gen Z and 52% of millennials consider themselves “chronically online”.

“If you’re already online reading all about the things happening in the world, it’s more likely that you’re going to really stress out and then look for those coping mechanisms”, Alev said.

A 2023 Bankrate survey showed that people who make social media-inspired impulse purchases spend an average of $754 annually. Ted Rossman, a senior industry analyst at Bankrate, noted that this behavior began during the pandemic and remains prevalent among younger adults, who face financial challenges like student debt and high housing costs.

Steps To Break The Cycle Of “Doom Spending”

“Doom spending” can have serious financial consequences, as U.S. credit card debt has surged to $1.14 trillion as of the second quarter of 2024, according to the Federal Reserve Bank of New York. Half of credit card users carry a monthly balance, the highest percentage in four years, as per Bankrate report. Additionally, six in ten credit card holders have been in debt for a year or longer.

With interest rates still high – average annual rates for regular credit cards are around 20.5%, while retail credit cards average 30.45% – debt becomes harder to manage. This debt buildup makes saving difficult, creating a cycle that is hard to escape.

Rossman advised those facing spending pressures to take back control by setting a financial plan. If you know you’ll feel the urge to spend, especially during the holiday season, plan for it in your budget ahead of time. This strategy reduces impulsive purchases and allows for mindful spending. Rossman also suggested setting aside this money in a high-yield savings account to earn interest while helping build a buffer for future expenses.