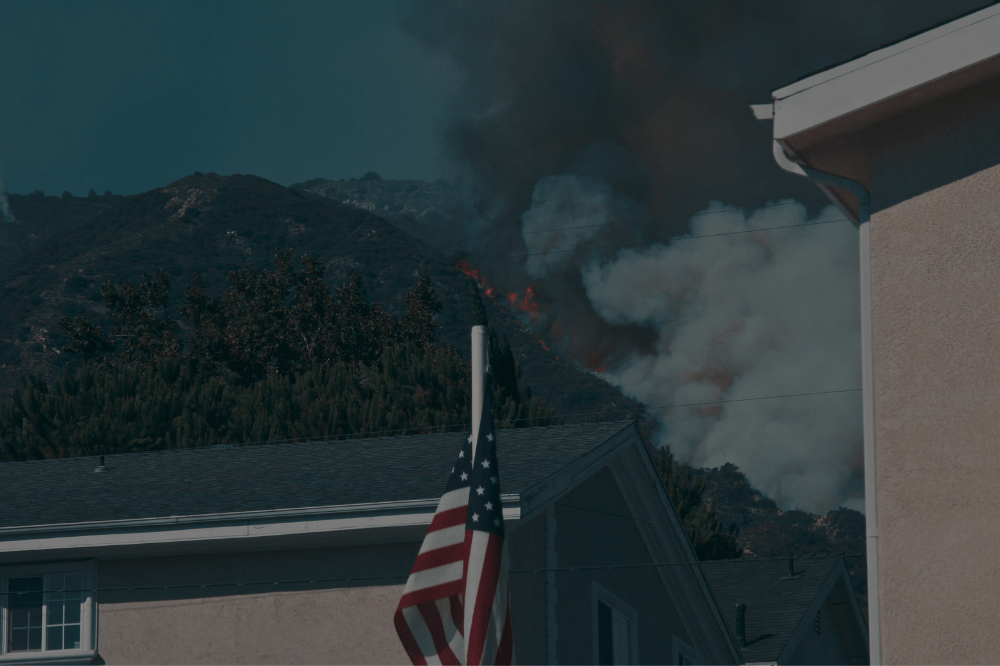

If you lost your home or business in the California wildfire, find out how to proceed with your insurance claim!

With over 2,000 structures destroyed by raging wildfire in Southern California (Los Angeles), homeowners and business owners face the challenge of rebuilding their lives and properties. One key step is filing an insurance claim, a process that can be complicated, especially as insurers have been reducing or cancelling coverage in fire-prone areas. Here’s how to approach this process effectively and secure the best possible outcome.

My Home Was Damaged or Destroyed in The California Wildfire: What Should I Do?

Once you and your loved ones are safe, contact your insurance company to file a claim. You’ll need to describe the damage, after that an insurance adjuster will investigate your claim to determine coverage and payout.

Keep in mind that resolving wildfire-related property claims can take months – or even years – depending on the insurer, the severity of damage, and the number of claims filed in the area. If your home is destroyed during a declared state of emergency, as the current wildfires in California, insurers must provide certain immediate payments, such as:

- Personal Belongings: a minimum of one-third of the estimated value of your contents.

- Living Expenses: at least four months worth of local rental costs.

According to Michael Soller, a spokesperson with the California Department of Insurance, these payments must be made even if an adjuster hasn’t yet inspected your property. You can also request cash advances for essential living expenses, such as temporary furniture rentals. Some companies even provide fully furnished temporary accommodations.

How Can I Make The Insurance Process Quicker?

- Start a Recovery Diary: document every interaction with your insurance company, including names, dates, phone numbers, and details of conversations.

- Keep Paperwork Organized: photograph receipts for expenses like hotel stays for easy access.

- Document Damage: take photos of your property before any cleanup begins. Create a detailed inventory of damaged and destroyed items.

- Follow Up: after speaking with an adjuster, send a follow-up email summarizing the discussion. This creates a clear paper trail and minimizes confusion.

What Happens After the Insurance Adjuster Inspects My Home?

If the adjuster makes an on-the-spot settlement offer, don’t rush to accept. Annie Barbour, a coordinator for United Policyholders, a nonprofit insurance and consumer rights advocacy group advised consulting an experienced construction professional and reviewing your policy to ensure the settlement aligns with your coverage.

“It’s all a negotiation and you don’t want to settle too soon. You can accept checks as long as none of them say final payment”, she noted.

“We’re just asking people to call our department, do not sign anything under duress. This is a very traumatic moment… and we want to let them know that please look out for fraud, do not sign anything, and we’re here to be able to help them through the entire process”, said Ricardo Lara, an Insurance Commissioner in California.

How Much Will My Insurance Pay?

Your payout will depend on your policy and the coverage you paid for. Typically, insurers cover the amounts that costs to repair or rebuild your home to its previous condition. For example, if your older home didn’t have a garage or a heating system, your policy won’t cover adding those features during repairs.