If your financial goal for 2025 is to pay down debt, check out these tips that can help you get there!

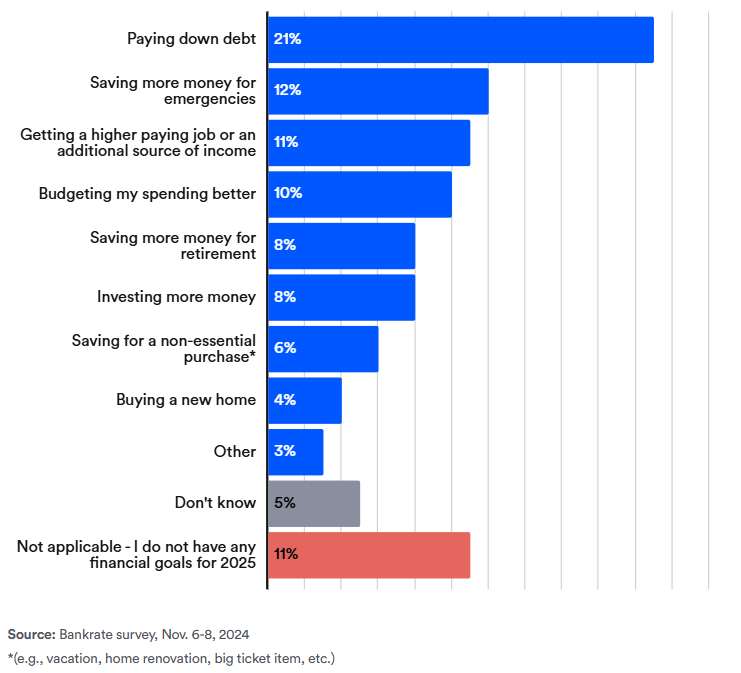

As 2025 approaches, many Americans are setting their resolutions for the year ahead. According to a recent Bankrate survey, conducted in November with nearly 2,500, 89% of Americans have a primary financial goal for 2025. Among them, 21% are focused on paying down debt. Other key goals include:

- Saving for Emergencies: 12%

- Finding Higher-Paying Jobs or Additional Income Sources: 11%

- Improving Budgeting and Spending Habits: 10%

- Boosting Retirement Savings: 8%

- Increasing Investments: 8%

- Saving for Non-Essential Purchases: 6%

- Buying a New Home: 4%

These goals come after a challenging year for many. Despite easing inflation, prices for some goods remain high, and credit card debt has reached a record of $1.17 trillion.

On average, credit card borrowers owed $6,380 in the third quarter of 2024, according to TransUnion.

Even borrowers with excellent credit scores face average credit card interest rates of 20.35%, only slightly lower than August’s 20.79%, according to Bankrate’s senior economic analyst Mark Hamrick.

″It could be injurious to personal finances if people accumulated debt that they’re not substantially paying down. It’s prudent and heartening to see that people are identifying debt broadly as something they want to address in the coming year”, Hamrick said.

The Path to Reducing Debt

Paying down debt requires rethinking financial habits. A survey by Allianz Life Insurance Company found that many Americans struggle with bad money management. Among them, 30% said they spend on unnecessary items, 28% do not save money at all, 27% save only a little, 23% don’t pay off debt quickly enough, and 21% spend more than they earn. In order to change that, individuals need to take proactive steps.

According Matt Schulz, chief credit analyst at LendingTree, one practical step is to contact your credit card company and request a lower interest rate.

Other strategies include 0% balance transfer offers, allowing you to avoid interest temporarily, and a personal loan with a lower rate, which can help consolidate and manage debt more efficiently.

While paying off debt is important, building a financial safety net shouldn’t be overlooked. Experts recommend saving three to six months’ worth of living expenses to cover unexpected emergencies, such as car repairs or medical bills.