Despite inflation drop, many Americans are still living paycheck to paycheck, according to research!

The high inflation rates of the pandemic have decreased, yet many Americans still feel they’re living paycheck to paycheck, according to recent findings by Bank of America. This trend spans across income levels from under $50,000 and over $150,000 per year, affecting especially lower-income households.

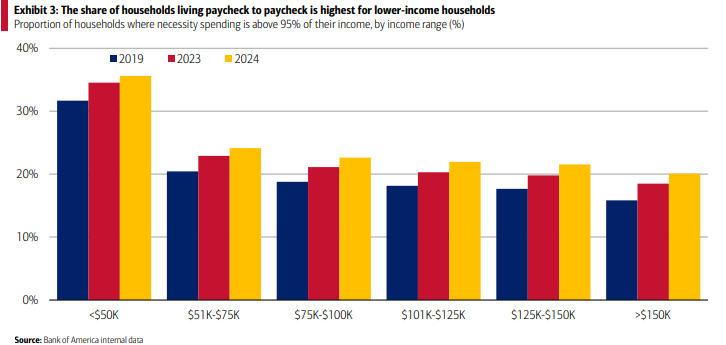

Since 2019, the share of households living paycheck to paycheck has grown. Approximately 35% of households earning under $50,000 are in this position, up from 32% in 2019. Higher-income households making over $150,000 are also affected, with around 20% of them reporting similar struggles.

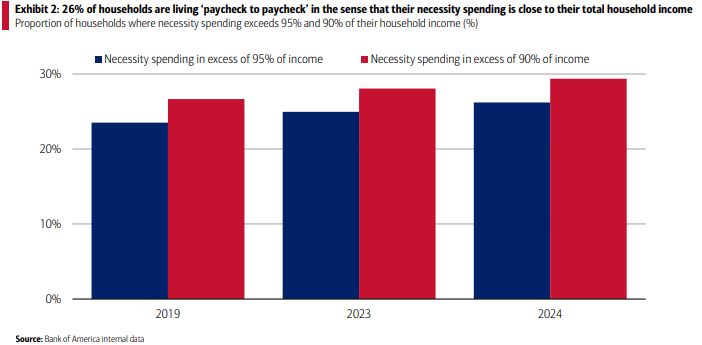

While personal perception plays a role in how people view their financial constraints, Bank of America’s third-quarter study showed that nearly half of those surveyed agreed they live paycheck to paycheck. Another analysis of the bank’s internal data shows that around 26% of households actually spend nearly all their income on necessities like gas, groceries, utilities, internet, public transportation, and healthcare.

Wages vs. Necessities

Economic challenges have led to a prolonged feeling of financial strain, known as “vibecession”, despite the U.S. economy avoiding a full downturn. While wage growth has helped ease the impact of rising prices for some, others have not seen increases that fully counterbalance inflation on essential goods and services.

“It’s not surprising that everyday necessity spending is swallowing up almost some people’s entire income. For some people in the population, the wage growth they’ve seen just isn’t enough to counter the inflation they’ve seen on their basket of essentials”, said David Tinsley, senior economist at Bank of America Institute.

Higher Interest Rates

Many families are finding it harder to keep up with expenses. Rising interest rates have pushed up borrowing costs for credit cards, car loans, and home improvements. The pressure on finances is making it challenging for middle-class families to meet traditional goals, such as home ownership, education, and family care.

“The American Dream of sending your kids to a good school and taking care of your family and living even in a modest home requires a potentially significantly larger income than it did even 10, 20 years ago”, said Nick Roth, a financial planner at Foster & Motley in Cincinnati.

Financial Strategies

Experts suggest that certain financial moves can help ease budget constraints. Reducing debt balances can free up cash for other expenses and reduce the total interest paid over time. “While it may not feel like a savings item, you are improving your net worth by paying off debt”, Roth pointed out.

Setting up automated transfers of small amounts to savings accounts can help individuals and families gradually build a financial cushion for emergencies. Roth recommended aiming for a savings level where people feel they are living paycheck to paycheck after setting money aside. This approach allows people to spend with confidence on what’s left after saving.

Additionally, maintaining long-term financial goals, like saving for retirement, remains important. Switching to pre-tax contributions for retirement, such as traditional 401(k) plans, can free up cash now by reducing taxable income.