According to research, credit card debt is at a record high total of $1.17 trillion among Americans!

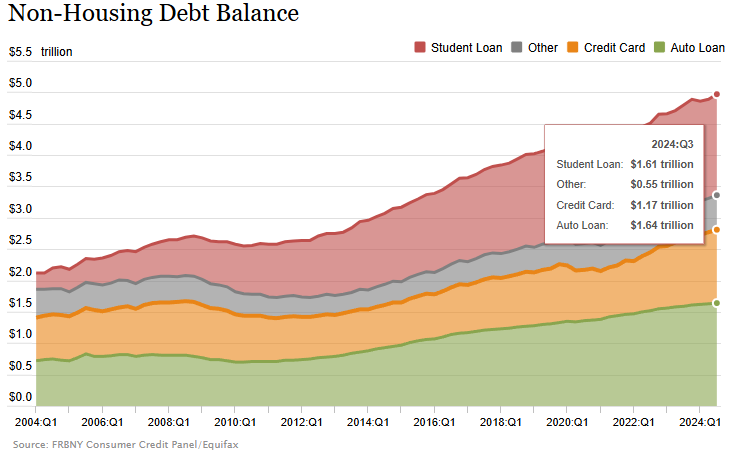

Americans collectively owe a record high debts of $1.17 trillion on their credit cards, according to the Federal Reserve Bank of New York’s latest household debt report. In the third quarter of 2024, credit card balances increased by $24 billion, an 8.1% rise compared to the same time last year.

Despite this, delinquency rates showed improvement, with 8.8% of balances transitioning to delinquency over the past year, down from 9.1% in the previous quarter. This decline suggests that “rising debt burdens remain manageable”, according to Federal Reserve researchers.

“Overall, balance sheets look pretty good for households”, the researchers noted during a press call on Wednesday.

The years following the pandemic had households depleting their excess savings, leading to a surge in credit card balances. And despite higher borrowing costs, strong consumer spending continues. However, the pace of credit card debt growth is now slowing. A separate report by TransUnion revealed that the average credit card balance per consumer is $6,329, reflecting a modest 4.8% annual increase. This is a significant drop compared to the 11.2% rise the year prior.

A recent Achieve survey showed that 42% of the 2,000 adults polled reported no change in their total debt over the past three months, while 28% said their debt had increased. Most of those experiencing higher debt mentioned struggles to cover basic living expenses, while others blamed overspending, job loss, or reduced income.

“Across the board, unemployment is low and wages have risen, but those macroeconomic conditions aren’t felt equally across the population, especially for consumers who live in areas where the impact of inflation is the greatest”, Brad Stroh, Achieve’s co-founder and co-CEO, said in a statement.

Credit cards continue to be one of the costliest borrowing options. Lower-income households, in particular, are feeling the strain after the Federal Reserve’s 11 consecutive interest rate hikes, pushing average credit card interest rates to over 20% – close to an all-time high. Even with Fed lowering its benchmark rate, credit card rates remain largely unchanged.