According to Consumer Price Index, the inflation has risen in October, making things like housing extremely inaccessible!

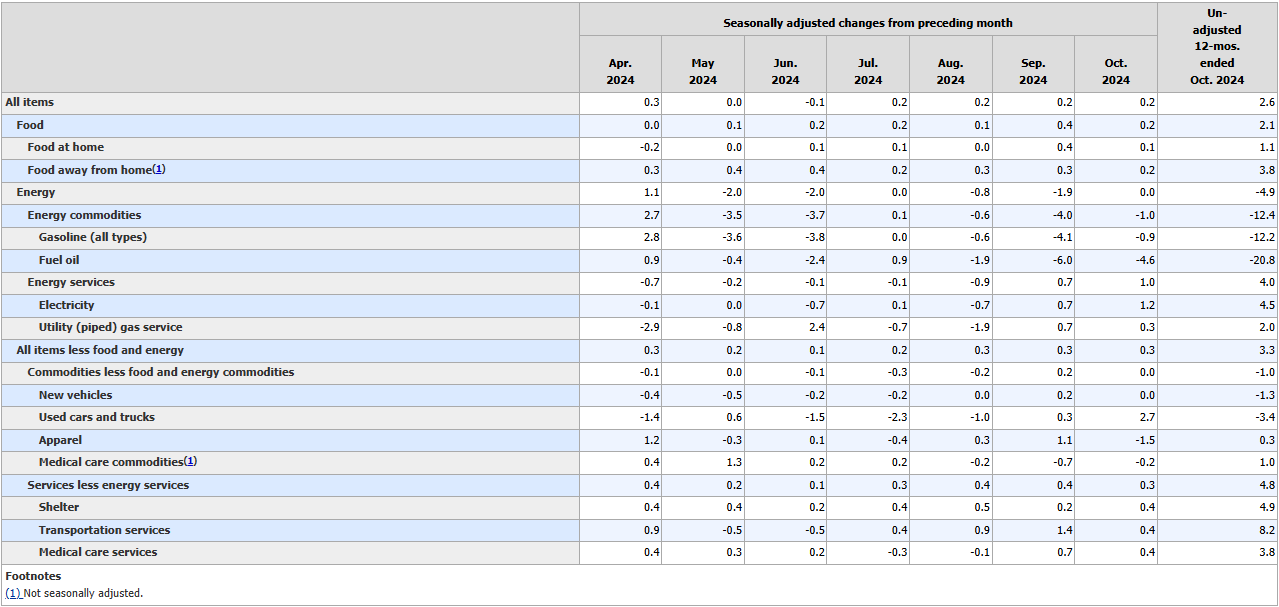

Despite falling gas prices and easing costs for things like groceries, October saw no progress in reducing pandemic-era inflation. According to the Bureau of Labor Statistics, the Consumer Price Index (CPI), a key inflation measure, rose by 2.6% in October compared to the previous year, which is up from 2.4% in September. While this October increase may seem like a setback, both economists and policymakers assure that overall inflation pressures are easing.

During a press conference, Federal Reserve Chair Jerome Powell pointed out that inflation is following a gradual, sometimes uneven, downward trend, saying, “one or two really good data months or bad data months aren’t going to really change the pattern at this point”. Economists attributed part of the annual increase to a statistical effect: October 2023’s inflation was unusually low, making this October’s reading appear higher by comparison.

Lingering Impacts

Since its peak of 9.1% in June 2022, inflation has significantly decreased, but some areas are still struggling. For example, auto insurance prices have surged 14% since October 2023, according to CPI data.

Stephen Brown, deputy chief North American economist at Capital Economics, explained that rising auto insurance premiums are partly due to price spikes for new and used vehicles starting in 2021, driven by a semiconductor shortage that affected car manufacturing. These higher replacement costs have increased insurer expenses, and since insurance rate hikes typically require regulatory approval, they’ve been slow to catch up.

Similar delayed inflation effects are impacting other categories, contributing to the overall slow progress in reducing inflation. Housing is the largest component of the CPI and one of the most challenging areas to address in inflation. Although national rent inflation has slowed, it hasn’t fully translated to shelter inflation in the CPI, which has been slow to adjust up or down.

Powell noted that newly signed leases are showing very low inflation, but shelter inflation remains high as it “catches up” to current conditions, a result of how federal statisticians record the data. Shelter inflation rose on a monthly basis in October, increasing from 0.2% in September to 0.4%. While the annual shelter inflation rate has dropped below 5% from a peak above 8% in early 2023, remaining a significant barrier to reducing overall inflation.

Some Relief in October

Consumers did experience some relief in October, particularly at the grocery store and gas pump. Grocery inflation moderated month-over-month, to only 0.1% from September to October, compared to 0.4% the prior month. Overall, grocery prices are up about 1% from October 2023. This stability in food costs is notable despite ongoing supply issues for specific items like eggs and oranges, which have been impacted by factors such as avian flu and poor crop yields.

Gas prices also eased, falling 1% in October. Over the past year, gas prices have dropped more than 12%. Mark Zandi, chief economist at Moody’s, noted that average gas prices could drop below $3 per gallon, further easing financial pressure on consumers, as global oil prices remain low.