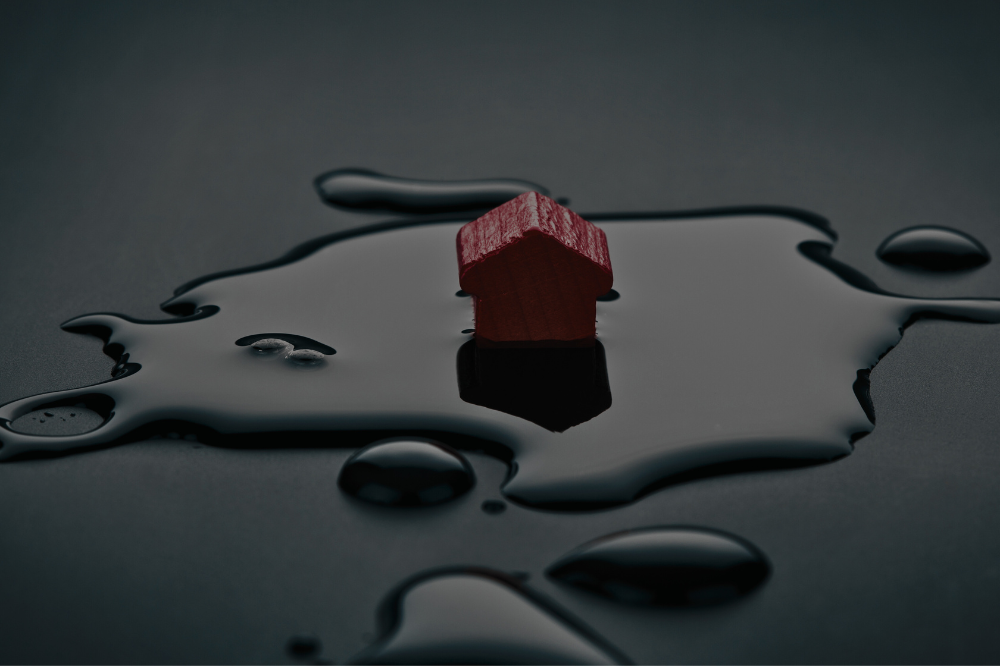

The deadline for the National Flood Insurance Program may affect homebuyers! Find out how!

Homebuyers have been eagerly waiting for the Federal Reserve to lower interest rates, a move expected in September. However, another significant change could occur at the end of that month, complicating the process of buying, selling, or refinancing a home in certain areas. The reason for this potential disruption is the National Flood Insurance Program (NFIP).

The government-backed program, which is the largest flood insurer in the U.S., needs to be reauthorized by September 30. Without reauthorization, the NFIP won’t be able to issue new policies or increase coverage on existing ones.

Homeowners insurance usually doesn’t cover flood damage, so those looking to protect their homes from floods need a separate flood insurance policy. Lenders often require this insurance for properties in high-risk flood zones.

“This is about the ability to get a mortgage in a flood zone after Sept. 30. Without an [NFIP] extension, you’re not going to be able to get a mortgage in any area that requires flood insurance”, said Jaret Seiberg, a managing director and financial policy analyst at TD Cowen.

The NFIP was created by Congress in 1968 to provide affordable flood insurance coverage. Its authorization expired on September 30, 2017, but Congress has extended it 30 times since then, with three brief lapses during that period.

“This has been an issue now for many years where the program faces expiration and Congress, [at the] last minute, reauthorizes it. We’re trying to prevent natural disasters, but we seem to always face this potential man-made disaster of not acting timely enough”, said Bryan Greene, vice president of policy advocacy at the National Association of Realtors.

Impact of an NFIP Lapse on Home Sales

If the NFIP is not reauthorized in time, it cannot issue new policies or increase coverage on existing ones, including for refinancing mortgages. This could delay or even halt home sales until buyers can obtain flood insurance, possibly requiring Congress to act or forcing buyers to seek private insurance.

Finding private flood insurance can be challenging. As Daniel Schwarcz, a professor of law at the University of Minnesota Law School who focuses on insurance law and regulation, explains, “there are very few private insurers that offer any type of flood insurance. There are some very niche types of policies out there… the NFIP is the only available option for flood insurance”. Without the NFIP, even the limited private market could shrink further. Seiberg warned, “if you eliminate that foundation, the rest of the market isn’t there”.

A lapse in the NFIP has had significant effects in the past. For example, when the program lapsed for a month in 2010, 6% of real estate agents reported delayed or canceled sales, according to a report by the National Association of Realtors. The report estimated, at the time, that a one-month lapse could affect about 40,000 closings.

“If you are buying or selling a house, you want to avoid the end of September and the beginning of October. There is no need to take the risk that the flood insurance program will lapse when you could close ahead of Sept. 30”, said Seiberg.

How Homeowners Would Be Affected

The NFIP currently covers 4.7 million policyholders and protects over $1.28 trillion in assets. If the NFIP lapses, existing policyholders will still have coverage, and claims will still be paid, according to FEMA.

Homeowners with flood insurance policies expiring around September 30 should renew early, advises Yanjun Liao, a researcher specializing in natural disaster risk management. “Check the expiration date and make plans in advance”, she suggests. Those considering refinancing should also keep the deadline in mind, especially if their lender requires flood insurance.