Even APRs that can top 30% aren’t discouraging shoppers from choosing retail credit cards!

Despite rising interest rates, many shoppers still prefer retail credit cards over other financing options. According to a LendingTree survey, 58% of shoppers favored store credit cards over buy now, pay later (BNPL) plans, while 42% opted for BNPL. The survey, conducted in September, included responses from 2,040 U.S. adults.

In December, the average annual percentage rate (APR) for new retail store credit cards reached 32.66%, a significant increase from 27.7% in 2022, according to the Consumer Financial Protection Bureau. While many BNPL plans offer short-term interest-free options, their long-term loans can carry interest rates comparable to store cards.

Younger shoppers, particularly Gen Z and millennials, are driving the popularity of BNPL services. The survey found that 59% of Gen Z and 51% of millennial respondents preferred BNPL over retail credit cards. In contrast, 38% of Gen Xers and only 22% of baby boomers showed the same preference.

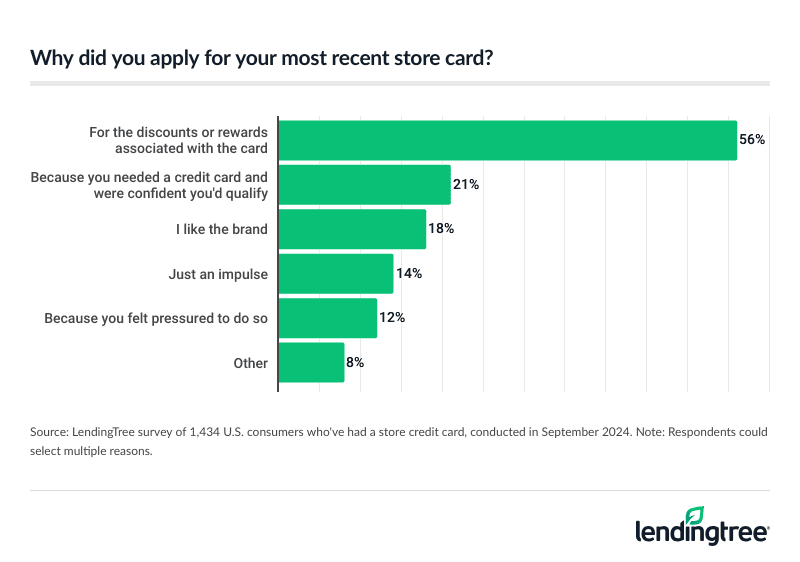

Of those who’ve applied for a store card in the past, 56% of them say they did so for the discounts and rewards associated with the card, while 21% say it’s because they needed a card and knew they would qualify.

Retail credit cards are often easier to qualify for than traditional credit cards, especially as banks tighten their lending standards. In 2024’s third quarter, banks implemented stricter credit card approval criteria, lowered limits, and increased minimum credit score requirements, according to the Federal Reserve.

“It’s a reaction from the banks to rising delinquencies, rising debt and overall economic uncertainty”, said Matt Schulz, chief credit analyst at LendingTree.

How Store Credit Cards and BNPL Work

Store credit cards and BNPL loans serve similar purposes but operate differently:

- Retail Store Credit Cards: these cards are revolving credit accounts offered by retailers in partnership with banks. To attract new users, retailers often provide perks like discounts on the first purchase or special financing offers. Many store cards are linked to loyalty programs, offering bonus rewards to cardholders.

- Buy Now, Pay Later Loans: BNPL services divide a purchase into installment payments over a fixed period. Some providers offer extended repayment plans, which may include interest. Unlike store cards, BNPL allows users to take out multiple loans simultaneously, each with its own terms.

Both options require timely payments to avoid penalties such as fees or interest charges. Remember, credit cards affect your credit history since they are reported to major credit bureaus (Equifax, Experian, and TransUnion). Some BNPL providers are now also reporting some loans to the credit bureaus.