Want to know how you can build a credit score having no credit history? Find out what to do in order to achieve that!

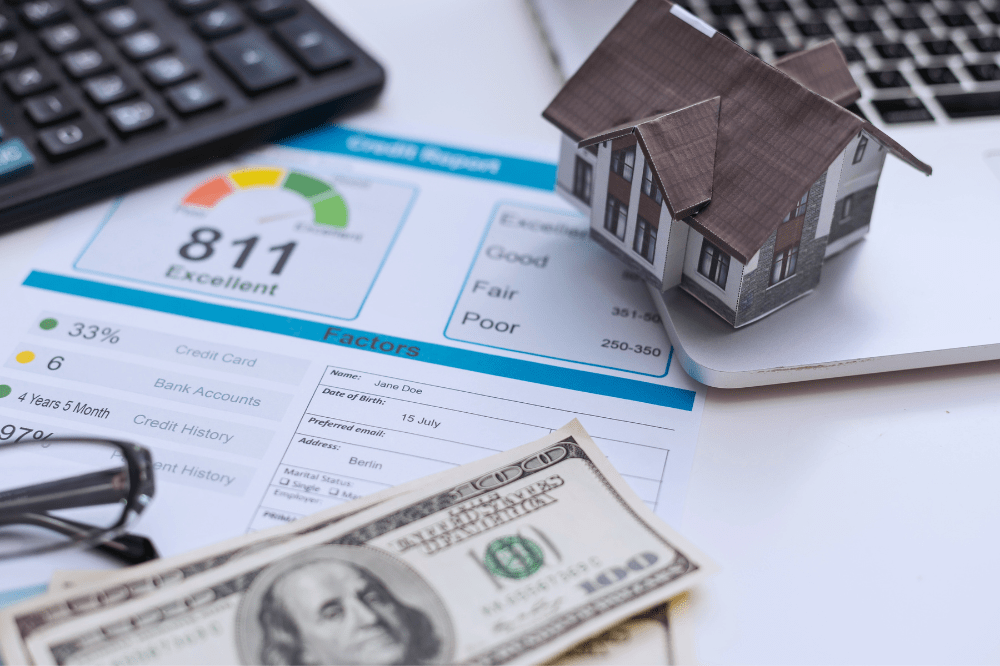

You know that having a good credit score is a fundamental part of your finacial life, your score will determinate your creditworthines allowing lenders to figure out how likely you are to repay a loan. The better it its, the greater are the benefits and opportunities you can unlock, from securing favorable interest rates on loans and mortgages to qualifying for better apartment rentals and even getting a good deal on car insurance. But if you’re new to this, you might be wondering “how can I build a credit score having no credit history?”. Don’t worry, it is entirely possible, and that’s what we are going to talk about!

So, if you’re looking for answers to this question, keep reading and find out how you can start building your score. Also, if you want to check out more financial tips on our website, you can click on this link!

How Does A Credit Score Work?

It is a three-digit number created by the Fair Isaac Corporation (FICO) and is widely used by lenders in the United States to assess your credit risk. They are calculated using complex algorithms that analyze various aspects of your credit report. These reports contain details like your payment history, credit utilization ratio (amount of credit used compared to available credit limit), credit card debt, loan history, and the length of your credit history. FICO Scores are calculated using information from your credit reports, such as:

- Payment history (around 35% weightage): is the most significant factor and considers how timely you’ve made payments on credit cards, loans, and other obligations;

- Amounts owed (around 30% weightage): this looks at your total debt compared to your available credit limit. Ideally, you should keep your credit utilization ratio low (below 30%) for a positive impact;

- Length of credit history (around 15% weightage): the longer your credit history, the better, as it demonstrates responsible credit management over time;

- New credit (around 10% weightage): applying for too much new credit in a short period can raise a red flag for lenders, potentially lowering your score;

- Types of credit used (around 10% weightage): having a mix of credit accounts, such as credit cards and installment loans, can positively impact your score.

The higher your FICO score, the better. They range from 300 to 850, and are classified as:

- Poor Score: between 300 and 579;

- Fair Score: from 580 to 669;

- Good Score: from 670 to 739;

- Very Good: from 740 to 799;

- Exceptional Score: from 800 to 850.

Having a good credit score (above 670) translates into several benefits. You’ll qualify for credit cards applications and lower interest rates on loans, including mortgages and auto loans. You might also enjoy better insurance premiums and favorable terms when renting an apartment.

How Can I Build Credit Score With No Credit History?

-

Become an Authorized User: this involves getting added as an authorized user on someone else’s established credit card account. Their credit history will then be reflected on your credit report, piggybacking on their good credit habits. However, choose someone responsible with their finances who makes timely payments and keeps a low credit card balance;

-

Get a Secured Credit Card: secured credit cards require a security deposit, typically equal to your credit limit. You use the card like a regular credit card, and responsible usage is reported to the credit bureaus, helping you build credit. Once you’ve established a good track record, the issuer might convert your secured card to a traditional unsecured credit card and return your deposit;

-

Consider a Credit-Builder Loan: this is a type of installment loan specifically designed to help build credit. You make fixed monthly payments over a specific term, and the loan payments are reported to credit bureaus. Once you repay the loan in full, you receive your initial deposit back;

-

Utilize Rent Reporting Services: did you know on-time rent payments can now positively impact your credit score? Some rent reporting services collect your rental payment history and report it to credit bureaus. This can be a great option, especially if you’re a responsible renter;

-

Explore Alternative Credit Reporting: Experian Boost is a program that allows you to link your utility, phone bill and streaming services bills payments to your credit report, potentially giving your score a boost.

Here are some crucial habits to cultivate as you build your credit:

-

Make On-Time Payments: set up automatic payments for your bills to avoid missed payments that can severely damage your score;

-

Keep Your Credit Card Balances Low: ideally, aim to utilize less than 30% of your credit limit. A high credit utilization ratio (the percentage of your credit limit you’re using) negatively affects your score;

-

Monitor Your Credit Report Regularly: you’re entitled to a free credit report from each bureau annually. Check for errors or inaccuracies that could be bringing your score down. You can request corrections if you find any mistakes;

-

Apply for New Credit Sparingly: every time you apply for a new credit card or loan, a hard inquiry is placed on your credit report, which can cause a temporary dip in your score. Only apply for credit when necessary.