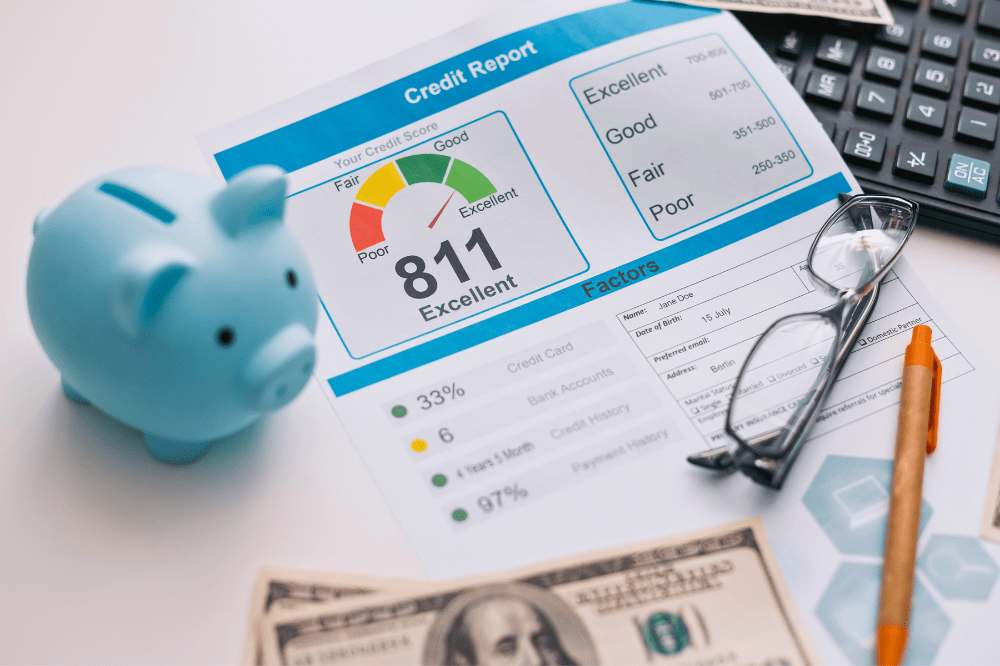

Do you know what are the different Credit Score Ranges and what each of them mean? Find out their impact and learn how to master your score!

A credit score is a three-digit number that reflects your creditworthiness. It evaluates your borrowing history and predicts the likelihood of you repaying future loans on time. In simpler terms, it tells lenders how responsible you’ve been with credit in the past. But do you know what are the different credit score ranges in the USA and what each of them mean? Let’s talk about that, so you can navigate the financial world!

In this blog post will delve into the different credit score ranges, their meanings, how they impact your financial life, and actionable steps you can take to improve your score. Also, if you want to check out more financial tips on our website, you can click on this link!

What Are The Different Credit Score Ranges?

Several key factors influence your credit score, like Payment History, Credit Utilization, Credit Age and Mix, and New Credit Inquiries. Credit scores in the USA range from 300 to 850, and are categorized as:

FICO Score:

-

Exceptional (800-850);

-

Very Good (740-799);

-

Good (670-739);

-

Fair (580-669);

-

Poor (300-579).

VantageScore:

-

Excellent (781-850);

-

Good (661-780);

-

Fair (601-660);

-

Poor (500-600);

-

Very Poor (300-499).

What Does Each Credit Score Range Mean?

Ranges are general guidelines, so it’s important to understand what each range mean and how they can impact your financial life. So, here’s a breakdown of each one of them:

Exceptional

- Favorable Interest Rates: you’ll qualify for the lowest interest rates on loans and credit cards, saving you significant money over the long term;

- Access to Premium Products: you may be eligible for exclusive financial products and rewards programs offered only to top-tier borrowers;

- Fast Approvals and Lower Fees: loan approvals are often streamlined, and you might receive lower fees associated with loans and credit cards.

Very Good

- Highly Competitive Rates: you’ll still qualify for very good interest rates and favorable terms on most loan and credit card products;

- Variety of Loan Options: access to a wide range of loan options from various lenders;

- Fast Approvals: loan approvals are generally quick and hassle-free.

Good

- Good Interest Rates: you’ll qualify for good interest rates on loans and credit cards, but they might not be the absolute lowest;

- Access to Most Loan Products: access to a good selection of loan products, although some lenders might have stricter requirements;

- Potential for Approval Delays: loan approvals might take slightly longer, and you might face some scrutiny from lenders, especially for larger loans.

Fair

- Higher Interest Rates: you’ll likely qualify for loans and credit cards, but interest rates will be significantly higher compared to better credit scores;

- Limited Loan Options: might have fewer loan options available, and lenders may offer less favorable terms;

- Potential for Loan Denials: lloan applications might be denied, especially for larger loans or those with stricter requirements.

Poor

- Difficulty Qualifying for Loans: you might have difficulty securing loans, or you might only qualify for subprime loans with very high interest rates;

- Limited Credit Card Options: you might only be approved for credit cards with high fees and low limits;

- Security Deposits: landlords or utility companies might require security deposits due to your credit risk.

How Can I Improve My Score?

Building and maintaining a a good score takes time and effort. Here are some steps you can take:

- Make On-Time Payments: this is the single most important factor. Set up automatic payments to avoid missed due dates;

- Pay Down Debt: reduce your credit card balances and other debts to lower your credit utilization ratio;

- Don’t Apply for Too Much Credit: space out credit applications and avoid applying for unnecessary credit cards;

- Become an Authorized User: being added as an authorized user on someone else’s credit card with a good payment history can improve your score;

- Get a Credit Report and Dispute Errors: regularly check your credit report for errors and dispute any inaccuracies that could be bringing down your score. You can access credit reports from each of the three major credit bureaus (Experian, Equifax, and TransUnion) or once a year through AnnualCreditReport.com.